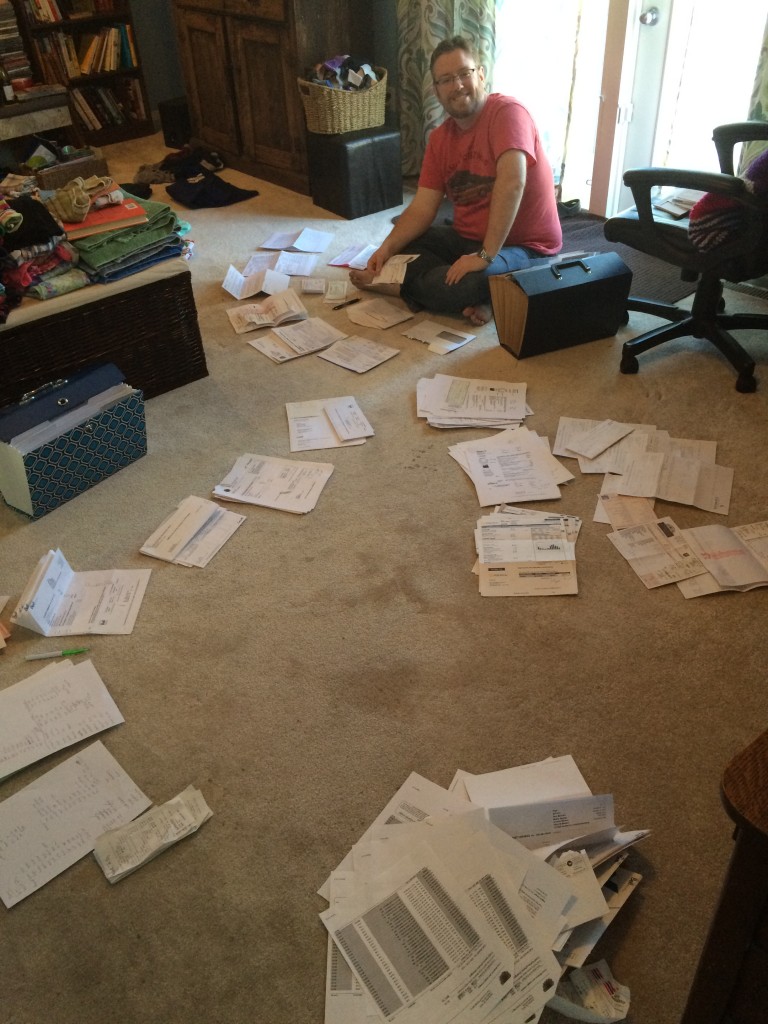

Want to see what we did last Saturday Night?

Tax time with a side of laundry.

Really, really, really wild Saturday Night at our house.

Our family was recently interviewed by the Toronto Star about the new federal budget and how it would benefit our family. One of the things we were asked was what we plan on doing with the extra money we would be receiving. In the interview, I immediately answered that we would probably be putting the windfall into the kids’ RESP or possibly taking a family vacation.

Yes, I really, really, really want to take a family vacation to Disneyland.

And we probably will. But, this year, we’re definitely using our tax return to top up the kids’ RESPs, because Zed and I both know what it’s like to go to school and not get a lot of financial support from our families.

So ideally this is what will happen: We will get our tax return and top up the kids’ RESPs, because in the long run it benefits not only the kids, but the entire family, because we can take advantage of the CESG (Canada Education Savings Grant). This grant tops up our annual RESP contribution by 20%, up to $500 per year. That means a lifetime maximum of $7,200 per child. Plus some qualifying families could even get 40% on the first $500 of annual contributions and up to a lifetime maximum of $7,200.

My husband and I both graduated from college in 2002, and we both just finished paying off our student loans a few months ago. If I can alleviate that strain from my kids by investing NOW, then I am going to. It has been really hard. Yes, I appreciated the student loans and I also did NOT use them as wisely as I could have, but that debt was VERY heavy to carry around for the last 14 years. We had to carry it through our marriage, through two homes and two kids. Not ideal for us.

When people don’t take advantage of these government programs, it really ticks me off. Was that too blunt?

But, really. You cannot afford to NOT do this for your kids. I mean, even if you don’t have the money, if you are eligible there is the Canada Learning bond that will start you off with $500 to deposit into your child’s RESP, plus if you are eligible, an additional $100 a year per child.

See? It feels like a no-brainer to me.

I want my children to be able to fulfill their dreams of a higher education and not be weighed down with the heavy load of student debt. I am going to help those little turkeys as much as I can. And I suggest you do too. If you get a tax return this year, please consider taking some of that money and investing in your kids’ futures.

And with that…

Look how cute these turkeys are!

I am a bit obsessive and bossy with my RESP thoughts. I would like to thank Heritage Education Funds Inc. for their support of this blog.